IN THIS EXCERPT

The content for this excerpt was taken directly from IDC MarketScape: U.S. Public Cloud Cold Storage Services 2020 Vendor Assessment (Doc # US46855520). All or parts of the following sections are included in this excerpt: IDC Opinion, IDC MarketScape Vendor Inclusion Criteria, Essential Guidance, Vendor Summary Profile, Appendix and Learn More.

IDC OPINION

IDC’s survey data consistently shows that enterprise storage growth will expand by upward of 30% annually. This relentless pace of data growth within enterprises, coupled with ongoing macroeconomic headwinds related to COVID-19, drives demand for low-cost enterprise storage solutions. Increasingly, these solutions can be found in the form of public cloud storage services designed with cost as a main factor. These platforms are typically marketed and used for “cold storage” — data that is accessed infrequently and typically associated with secondary storage use cases such as data protection, backup, or archive (as opposed to “primary” use cases such as ERP or CRM).

Cold storage use cases are increasingly valuable because, as companies collect more data, they simply are not able to extract all the business value from it. Enterprises understand that some of their data’s value is immediately recognizable, but they also understand that data has the potential to be valuable for future business endeavors or workflows. Instead of discarding this data, cold storage solutions make it increasingly cost effective to save data over the long term and capitalize on undiscovered value in the future. In addition to undiscovered data potential, there are more practical requirements driving long-term data storage, which are typically related to industry compliance and security regulations such as GDPR, HIPAA, or CCPA.

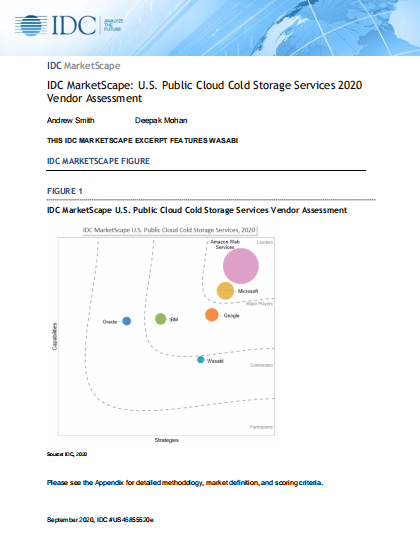

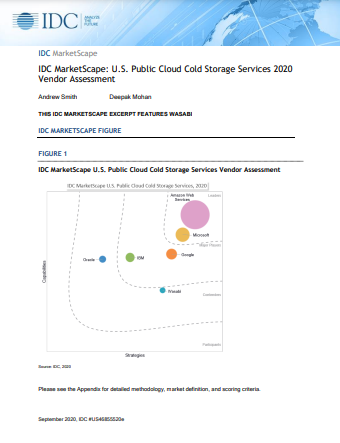

It is also important to note that the rise of cold storage services directly correlates to the rise of public cloud IaaS in general. The rapid pace of public cloud storage adoption drives expansion of use cases and the need for more specialized tiers of services like cold storage. Public cloud services providers are uniquely positioned to serve these cold storage use cases. These providers have built a significant infrastructure footprint and developed the economies of scale necessary to deliver storage at extremely low rates (typically price per gigabyte). Furthermore, almost all major public cloud storage providers now offer a “cold storage” service that is separately priced from the rest of their storage portfolio and designed specifically for long-term data retention use cases. The growing prevalence of these services warrants a distinct IDC MarketScape evaluation, which is designed from the perspective of enterprise IT customers, evaluating public cloud cold storage providers using the IDC MarketScape methodology.

IDC MARKETSCAPE VENDOR INCLUSION CRITERIA

This IDC MarketScape focuses on public cloud cold storage providers with services availability in the United States, which have also reached a critical revenue threshold and meet a baseline cost profile (dollar per gigabyte) for what we consider “cold storage.” Detailed inclusion criteria for service providers included in this IDC MarketScape are as follows:

- Service must meet IDC’s definition of public cloud IaaS; service must be built primarily on public cloud IaaS storage capacity.

- Service must be available in the United States.

- There cannot be any requirement for associated hardware/appliance gateways

- The price of the service must be equal to or less than $0.015 per gigabyte per month.

- The company’s IaaS storage revenue must be greater than $10 million/year (U.S. services revenue only)

- Public cloud–based file sync and share services are excluded.

To read full download the whitepaper:

IDC MarketScape: U.S. Public Cloud Cold Storage Services 2020 Vendor Assessment